Customer Services

Copyright © 2025 Desertcart Holdings Limited

💰 Elevate Your Financial Game: Because Knowledge is the New Currency!

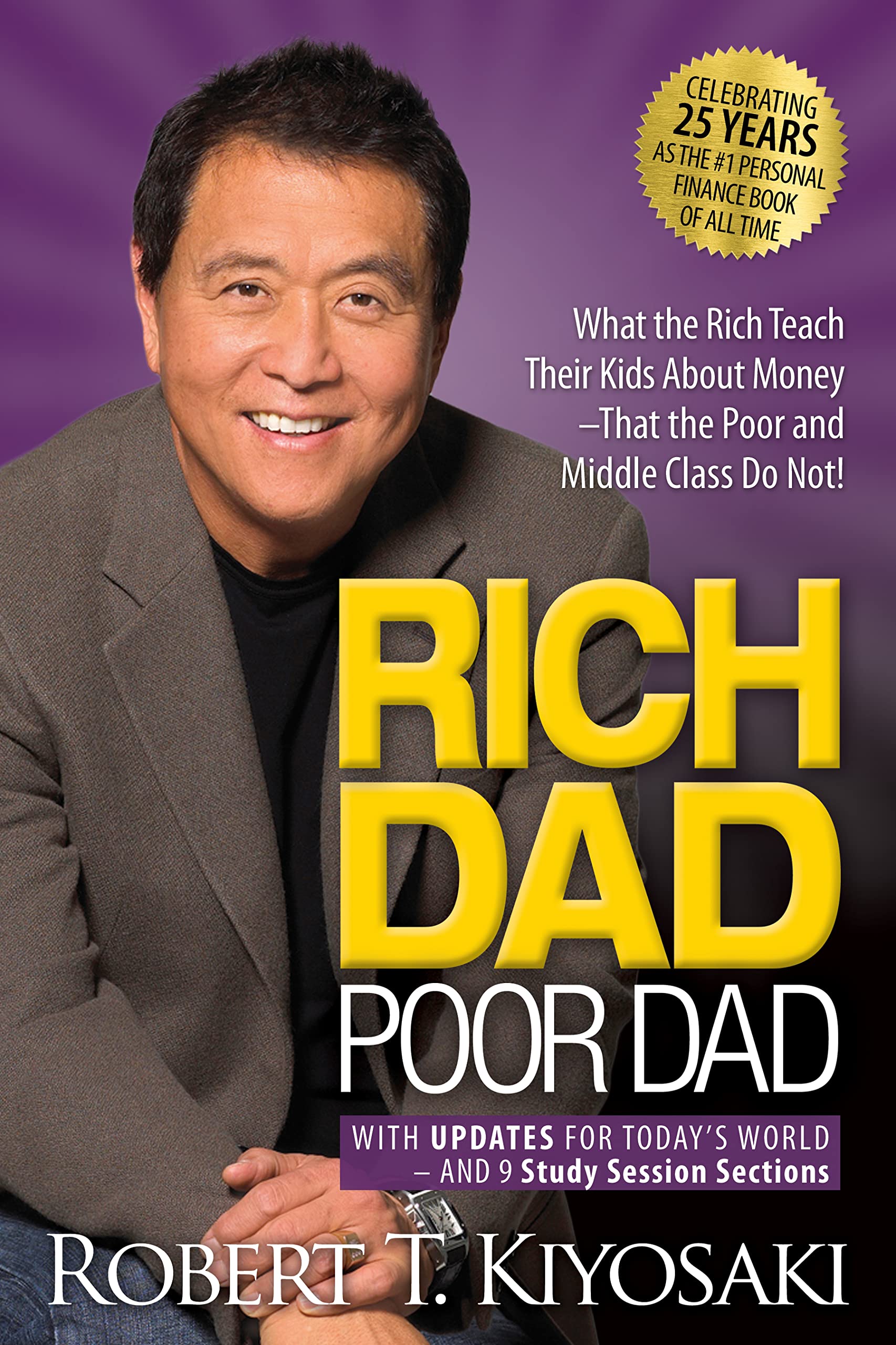

Rich Dad Poor Dad is a groundbreaking book that contrasts the financial philosophies of two father figures, offering readers invaluable lessons on wealth creation, financial independence, and the importance of financial education for both themselves and future generations.

| Best Sellers Rank | #157 in Books ( See Top 100 in Books ) #3 in Personal Finance (Books) |

| Customer Reviews | 4.7 out of 5 stars 106,134 Reviews |

H**R

Real Estate Investing Bible

Brilliant for mentality/mindset, not for literal technical advice, best first book to read for anyone interested in real estate.

R**N

Rich Dad Poor Dad

“Rich Dad Poor Dad” is one of those books that makes you stop and really think about the way you were raised to view money. I loved how simple and clear the author explains the difference between working for money vs. learning how to make money work for you.

O**T

Empowering Financial Wisdom - "Rich Dad Poor Dad" is a Must-Read!

"Rich Dad Poor Dad" by Robert Kiyosaki is an extraordinary book that has truly changed my perspective on money, wealth, and financial literacy. This insightful and empowering read presents invaluable lessons that the rich teach their children about money, contrasting it with the mindset and beliefs commonly held by the poor and middle class. Allow me to share my experience with this life-changing book. First and foremost, the knowledge and wisdom imparted by Robert Kiyosaki in "Rich Dad Poor Dad" are eye-opening. Through relatable stories and personal experiences, Kiyosaki challenges conventional beliefs about money and unveils the fundamental principles of financial success. He emphasizes the importance of financial education, investment strategies, and building assets to create lasting wealth. These powerful lessons have inspired me to take control of my financial journey and make better choices for a prosperous future. The storytelling approach used in this book is exceptional. Kiyosaki narrates his childhood experiences, highlighting the contrasting financial mindsets of his own "poor dad" (his biological father) and his "rich dad" (his friend's father). This storytelling style effectively communicates complex financial concepts in a relatable and engaging manner. It makes the book accessible to readers from all walks of life, regardless of their prior financial knowledge. The practicality of the lessons presented in "Rich Dad Poor Dad" is noteworthy. Kiyosaki not only shares insights but also provides actionable steps and strategies for readers to implement in their own lives. The book encourages readers to think critically about their financial decisions, challenge their beliefs about money, and take proactive steps towards financial freedom. It serves as a practical guide for individuals seeking to break free from the cycle of living paycheck to paycheck and create a solid financial foundation. Furthermore, the book's emphasis on financial literacy is of immense value. Kiyosaki stresses the importance of acquiring financial knowledge and understanding the different forms of income, assets, and liabilities. This focus on education empowers readers to make informed financial decisions and take control of their financial destinies. It serves as a wake-up call to the significance of financial literacy in achieving long-term wealth and financial security. The impact of "Rich Dad Poor Dad" extends beyond personal finance. It challenges societal norms and encourages readers to question the traditional path of education and employment. Kiyosaki promotes entrepreneurship and encourages individuals to think outside the box, take calculated risks, and embrace the opportunities that come with financial independence. This book has the potential to reshape one's mindset and open up a world of possibilities. Lastly, I must commend the author for his ability to inspire and motivate readers. Kiyosaki's writing style is engaging, passionate, and thought-provoking. His genuine desire to empower others to achieve financial success shines through every page, making "Rich Dad Poor Dad" a truly transformative reading experience. In conclusion, "Rich Dad Poor Dad" is a must-read for anyone seeking to gain financial knowledge, reshape their mindset, and create a solid foundation for long-term wealth. Its empowering lessons, relatable storytelling, practicality, emphasis on financial literacy, and inspiring approach make it a book that has the potential to change lives. I highly recommend "Rich Dad Poor Dad" to individuals of all ages and financial backgrounds. Pick up this book, absorb its wisdom, and embark on a journey towards financial independence and abundance!

K**R

---<br /><br />🌟🌟🌟🌟🌟<br />Life-Changing Perspective on Money and Wealth!

Rich Dad Poor Dad” is a must-read for anyone who wants to shift their mindset about money. I gave it 5 stars because it challenged the traditional beliefs I was taught growing up and opened my eyes to the importance of financial education. Robert Kiyosaki uses a powerful storytelling style to compare the lessons he learned from his two “dads”—one rich, one poor—and the contrast is eye-opening. It helped me realize how vital it is to understand assets vs. liabilities, the importance of investing, and why working to learn is more valuable than working just for a paycheck. This book is not just about getting rich—it's about becoming financially smart and breaking free from the cycle of living paycheck to paycheck. It gave me the confidence to start thinking like an entrepreneur and take control of my financial future. Highly recommended for anyone who wants to grow financially, change their mindset, and build true wealth.

C**Y

Some good points, but perhaps he overlooks certain facts

This book offers some good ideas that you may not be familiar with regarding investing and building a financial future. The basic tenets are that you should build your asset column, so that you can generate enough income in order to get out of the "Rat Race" (i.e., the daily 9-5 grind). Your assets are supposed to generate enough passive income to allow you to live off them alone instead of your "normal" job. These assets can come in many forms, but the most obvious or the biggest are real estate and stocks. I thought it was inspiring and a notable point that, instead of simply spending your paycheck to buy a car or a house or whatever, Kiyosaki recommends you buy assets that are able to generate that income as supplemental income. You'll use the additional income you receive from your assets to make those "luxury" purchases. The other good point made throughout the book is that you should grow your financial learning so that you have more tools at your disposal in order to build your financial future, beat the market, etc. On account of that I may be purchasing subsequent books in order to learn more about how the financial world works. Places where I think this book errs, however, is in the over-simplified assumption that we can all just become rich. He even seems to suggest it's due to a fear of risk or laziness that people don't become rich. I think life is more complicated than that and it is not easy to turn whatever additional wages you have from your 9-5 into a great fortune, although this book does help with certain financial principles. This is especially the case if you are led into debt by the things that he warns against - higher education, for instance. The other thing is that I feel like his story is different. The way he appears to have grown his fortune is through some savvy real estate move where he was able to see the opportunity in the real estate market and seize upon it. This also took a degree of patience, as he had to wait until the housing turned around on his investments before he could sell it and parlay that money into a bigger investment. I think the point he is missing is his intuitive knack for seeing these real estate opportunities that the general public may not see. Obviously he has a degree of cleverness in that regard. For myself, I wouldn't know how to see a great opportunity among all the rot, and I would have difficulty seizing upon it due to my own financial situation. Therefore, simply going for something that may not actually be a good opportunity would not be in my best interest. He also started early so he had little to no debt and was able to make these moves. I should also add that he has a passion for real estate, and for finances, that probably enables him to take the action he needs to. I am not sure I have that same passion or interest. In all, I think he offers some solid foundational advice for building your financial future, and makes some good points. These points by themselves make the book worth a read. I do however feel like he oversimplifies becoming rich and overlooks the fact that his unique situation made him well-poised to capitalize on his opportunities.

J**L

Good informational book

Good informational book as described. Worth the read for anyone

K**E

Very inspired

This book has me hooked from the moment I opened it. It’s very clear to read easy to understand and very eye-opening. It’s truths are simple, but hard to accept because the truth is so simple & plain

N**A

From Financial Anxiety to Confidence

Before reading this book, my financial state of mind was anxious. After finishing it, I feel confident. What made the difference for me was how clearly the book explains money using simple ideas like cash flow and balance sheets, often with diagrams. For the first time, I could actually see why money kept slipping through my hands, despite years of hard work. There were many moments while reading when I thought, “I wish someone had told me this earlier.” But instead of regret, the book gave me motivation to change how I think about money now. This book is especially useful for people who are financially illiterate or for those who are worried about becoming rich but don’t know where to start. It helped me rethink how my expenses were fueled purely by salary and how to look at money more intentionally. It may not appeal as much to people who are deeply into active investing, but for anyone looking to build a strong foundation in financial thinking, it’s invaluable. If someone asked me whether they should read this book, my answer would be simple: Yes. It will make you financially literate — something no one teaches you.

Trustpilot

4 days ago

1 month ago